Overview

Custom financial models to support planning, forecasting and investment analysis.

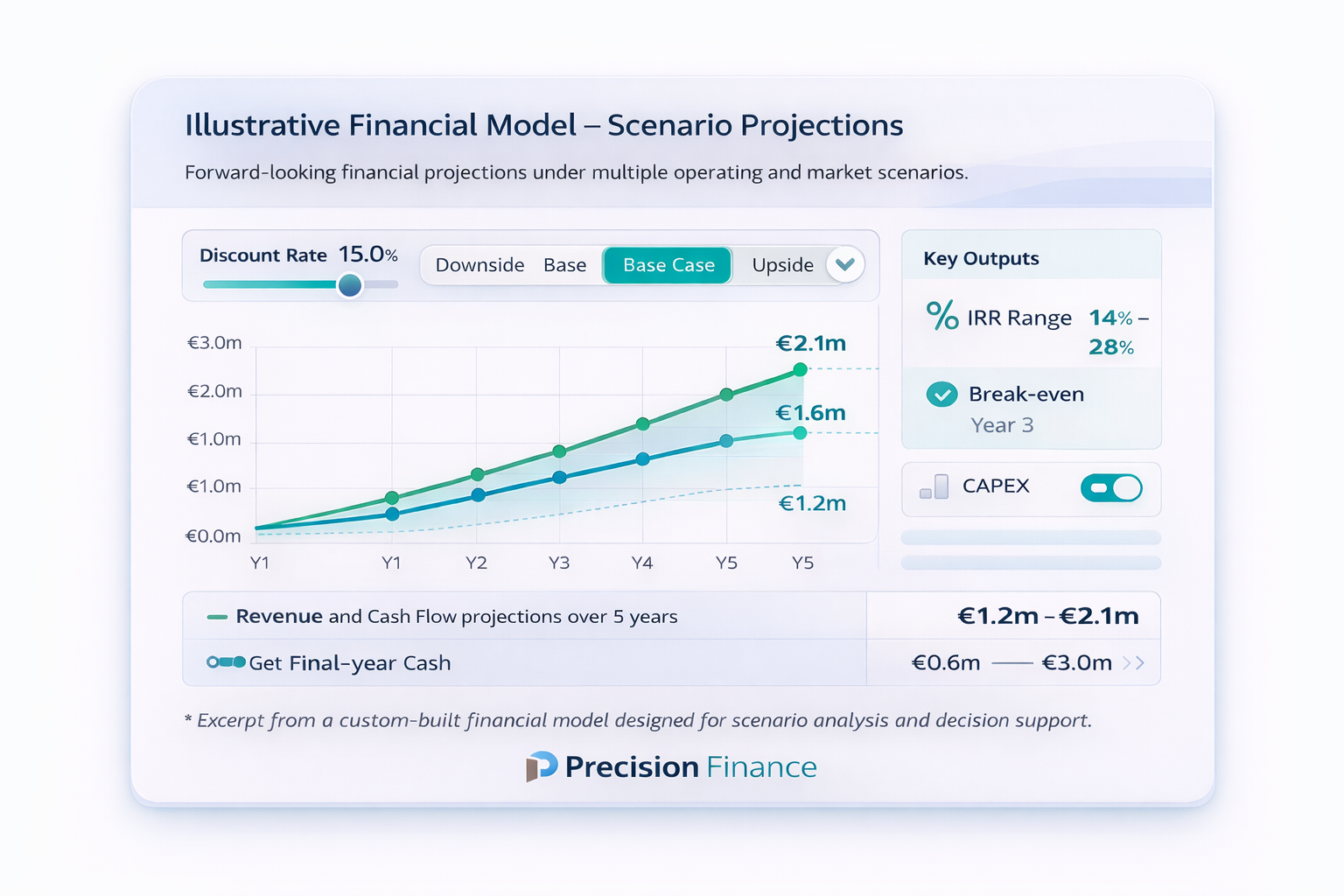

We design clean, accurate, and well-structured financial models tailored to your specific business and decision making needs.

Our models are built to support budgeting, scenario analysis, investment planning, and strategic decision making, and are suitable for use by management, investors, advisors, and lenders.

When Custom Financial Modelling Is Used

Custom financial models are commonly used for:

- Reviewing business performance and forecasting future years

- Business planning and budgeting

- Investment evaluation and scenario testing

- Growth and expansion analysis

- Capital structure and funding assessment

- Investor or stakeholder reporting

Deliverables

- Tailored financial model built to project requirements

- 5-year financial forecasts

- Tailored revenue and cost modelling

- Clear assumptions and scenario analysis

- Investor-ready financials

- Review, and stress testing of existing financial models

Technical Details

- Fully integrated three-statement models (P&L, cash flow, balance sheet)

- Scenario and sensitivity analysis

- Working capital cycles and seasonality modelling

- KPI dashboards and summary outputs

- Transparent structure with documented assumptions

Models are structured for clarity, auditability, and ease of review by banks, investors, and professional advisors.

Custom financial modelling is frequently used alongside Business Plans for Bank Loans and Business Valuations to support scenario analysis, funding decisions, and investment assessment.

Discuss your financial modelling requirements

Contact