Overview

Independent business valuation reports to support transactions, investment, and strategic decisions.

We provide professional business valuation reports that deliver a clear valuation range, key value drivers, and transparent assumptions.

Our valuations are suitable for shareholders, investors, advisors, and decision-makers who require an objective and well-supported assessment of business value. Valuations are prepared using recognised methodologies and are suitable for use in investment discussions, banking reviews, shareholder matters, and advisory engagements.

When a Business Valuation Is Required

A business valuation is commonly required for:

- Shareholder transactions or ownership changes

- Investment discussions or capital raising

- Strategic planning or exit preparation

- Dispute resolution or internal decision-making

- Independent assessment for advisors or stakeholders

Deliverables

Depending on project requirements, deliverables may include:

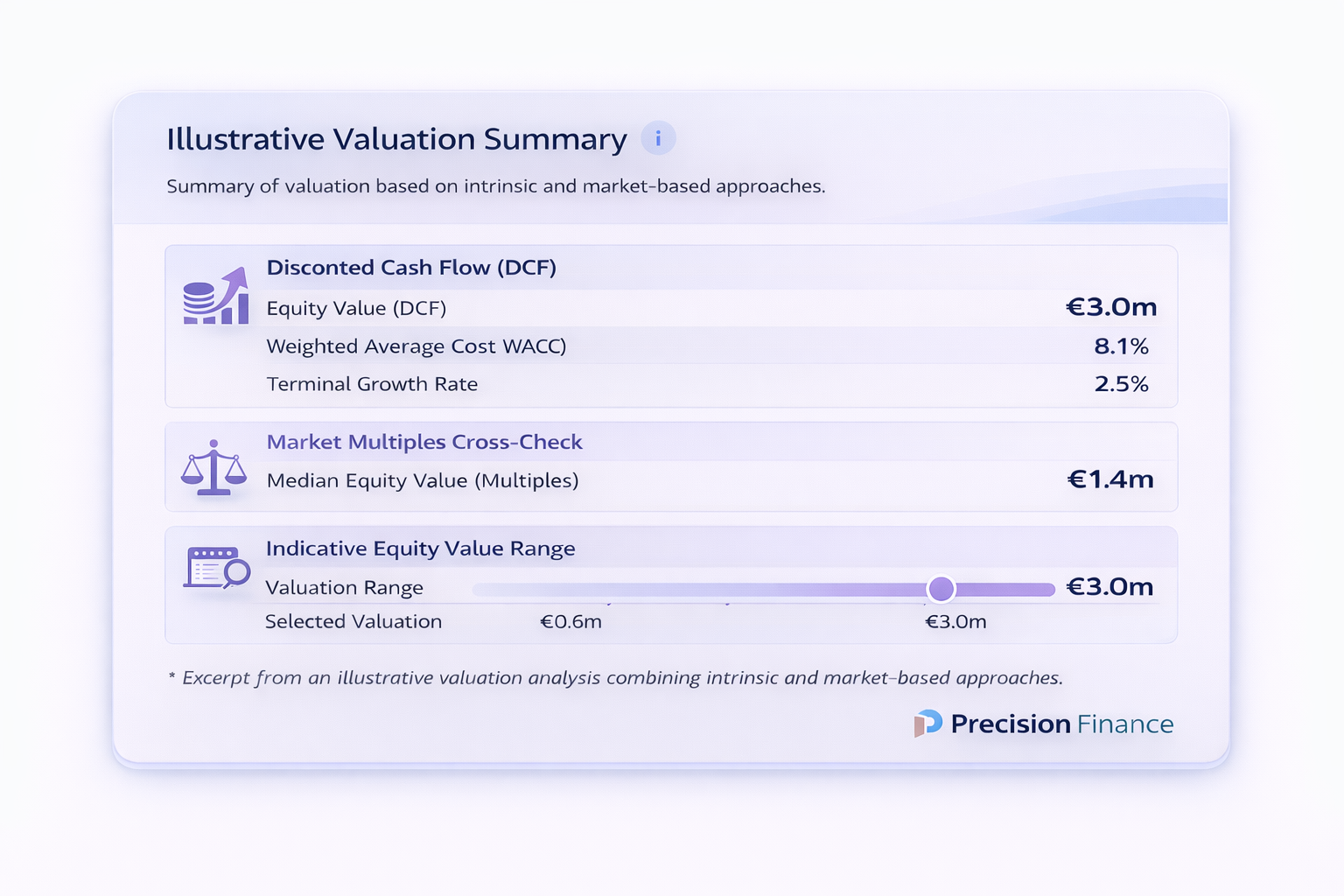

- Professional valuation report with clear valuation range and supporting analysis

- Discounted Cash Flow (DCF) valuation

- Market multiples comparison

- Sensitivity analysis

- Key insights and valuation drivers

Technical Details

- Full DCF methodology and supporting assumptions

- Market multiples analysis and triangulation

- Terminal value calculation and justification

- Sensitivity analysis on discount rate, margins, and growth assumptions

- Earnings normalisation adjustments

- Working capital and balance sheet adjustments

- Scenario based valuation ranges

The valuations are presented in a clear and easy to understand format, suitable for investors, banks, and advisors. The assumptions are assessed based on the Cypriot market and the specific risks of each business.

Business valuations are often supported by detailed Custom Financial Modelling and, for investment-related projects, may also be prepared alongside a Technoeconomic Analysis.

Discuss your valuation requirements

Contact