Overview

Clear financial analysis for successful loan applications.

Our business plans are designed to:

- Support loan applications and refinancing

- Clearly present the business model, risks, and repayment capacity

- Meet the expectations of banks and credit assessors

Our business plans combine financial analysis with clear presentation, allowing banks to quickly understand the business, assess risk, and evaluate repayment capacity.

They are suitable for both new and existing businesses seeking loans or refinancing.

Deliverables

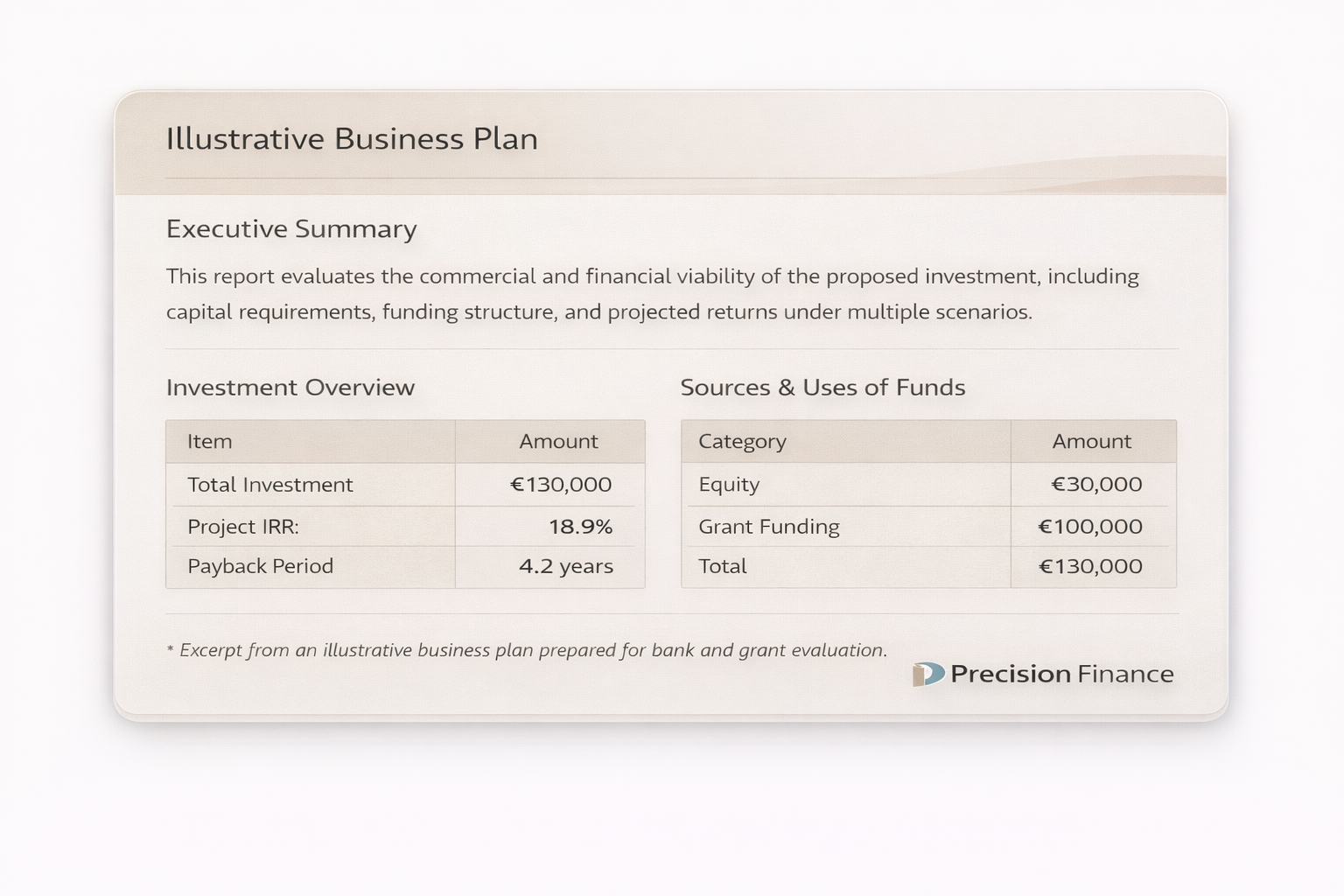

- Complete business plan in a bank-friendly format

- Five-year financial projections prepared for bank review

- Loan structure and DSCR analysis

- Market, competition, and operational overview

- Clear presentation of the business model and investment case

Technical Details

- Revenue and cost modelling

- Cash flow and working capital analysis

- Loan amortisation and DSCR calculations

- Break-even analysis

- Sensitivity analysis on key assumptions

- Implementation roadmap (Gantt chart where required)

- Competitor analysis and market positioning assessment

All reports are prepared to meet the expectations of banks.

For projects involving grants or larger investments, business plans are often prepared alongside our Technoeconomic Analysis and Custom Financial Modelling services.

Discuss your business plan requirements

Contact